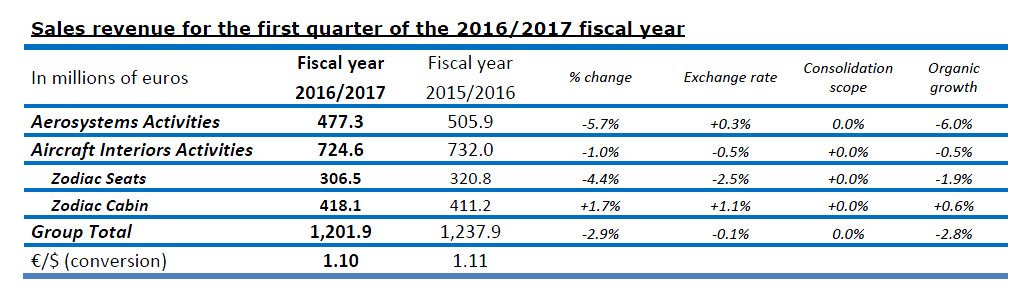

Plaisir, December 15, 2016 – Zodiac Aerospace reported sales of €1,201.9m for the first quarter of its fiscal year 2016/2017; -2.9% on a reported basis and -2.8% like-for-like. Foreign exchange rates had a -0.1 point impact on growth rate in the period. There was no impact from consolidation scope. This start of the year is supporting the scenario of a dissymmetry between H1 and H2 as presented on November 22.

Sales revenue for the first quarter of the 2016/2017 fiscal year

Aerosystems1 activities (39.7% of total revenue) reported €477.3m of sales: -5.7% on a reported basis and -6.0% on a like-for-like basis, excluding a positive 0.3 percentage point impact from foreign exchange rates. As in 2015/2016, Aerosystems is impacted by lower sales to Helicopter, Business jets and Regional jets markets, while the civilian arresting systems are showing a slow start of the year. This evolution is partly compensated by a good first quarter for aftermarket.

Aircraft Interiors activities (60.3% of total revenue) sales amounted to €724.6m in the first quarter, combining a negative -0.5 point forex impact and a -0.5% organic growth, and resulting in a -1.0% change over the first quarter of 2015/2016.

Zodiac Seats branch reported €306.5m sales in Q1, (-4.4%) compared to Q1 2015/2016 and breaking down into a negative -2.5 points Foreign exchange impact and a -1.9% organic decrease. This is reflecting the cycle impact of previous design and production issues, since the typical order-delivery cycle for a business class seat is estimated between 18 and 24 months.

Zodiac Cabin branch reported a +0.6% organic growth of its sales, reflecting ramp up of new programs. Adding a 1.1 point positive forex impact, sales increased by +1.7% to €418.1m.

OUTLOOK

Zodiac Aerospace pursues the execution of its recovery and transformation plan as detailed with the publication of the FY2015/2016 results on November 22, 2016. The first step of the plan consisting of resuming delivery performances to our customers was the main focus of the previous fiscal year. This has been reached or is under way in most of our activities. Zodiac Aerospace is progressing on track to achieve return to operational performance within end 2017, i.e. 18 months from the announcement of March 2016, which is the second step of the recovery plan. The implementation of the Focus transformation plan is currently on track, with the third set of standards being developed and the second step being implemented all across the Group. The third step consists of addressing operating margin recovery by removing remaining extra costs and production variances owing to cost cutting and efficiency actions. This should permit to resume double-digit operating income by FY2017/2018 and get back to historical profitability levels by FY2019/2020.

1 Including Entertainment & Seats Technology division as of September 1st, 2016. This division was previously integrated in the Cabin branch, within the Aircraft Interiors activities. The 2015/2016 and 2016/2017 figures have been restated to reflect this change.

2

Press Release – December 15, 2016

Zodiac Aerospace confirms its target for the FY 2016/2017. Sales should be stable, due to the drag from the past crisis lead time effect and the helicopter and business jets soft activity. The Current Operating Income is expected to show a 10-20% increase, with a strong dissymmetry between the first and the second half-year. For FY2017/2018, the Group expects its sales organic growth to progressively get back to historical levels and to reach a double digit margin for its Current Operating Income. Mid-double digit operating margin is expected at horizon FY2019/2020.

For 2016/2017, Zodiac Aerospace has hedged 87% of estimated EUR/USD exposure at 1.1184$/€ (spot rate), 79% of USD/CAD, 80% of USD/GBP, 71% of USD/MXN and 80% of USD/THB exposure, unchanged compared to November 22, 2016.

For 2017/2018, Zodiac Aerospace has hedged 55% of its estimated EUR/USD exposure at 1.0779 (spot rate).

NB : This revenues publication will be commented on an analysts & press conference call on December, 15th, 2016 at 6:00pm CET and broadcasted via our website www.zodiaaerospace.com. A replay will also be available on the Group website as well as the presentation slideshow and press release.

About Zodiac Aerospace

Zodiac Aerospace is a world leader in aerospace equipment and systems for commercial, regional and business aircrafts and for helicopters and spacecrafts. It develops and manufactures state-of-the-art solutions to improve comfort and facilities on board aircrafts and high-technology systems to increase aircraft performance and flight safety. Zodiac Aerospace has 35,000 employees worldwide and generated revenue of €5.2bn in 2015/2016. www.zodiacaerospace.com

Be the first to comment on "Zodiac Aerospace – Sales revenue for the first quarter of the / Q1 2016/2017 sales revenues"