| 07 August 2019 |

| The International Air Transport Association (IATA) released data for global air freight markets showing that demand, measured in freight tonne kilometers (FTKs), decreased by 4.8% in June 2019, compared to the same period in 2018. This marks the eighth consecutive month of year-on-year decline in freight volumes. Signs of a modest recovery in recent months appear to have been premature, with the June contraction broad-based across all regions with the exception of Africa. Capacity growth remains subdued and the cargo load factor continues to fall. Globally, trade growth is languishing, and business uncertainty is compounded by the latest tariff increases in the US-China trade dispute. “Global trade continues to suffer as trade tensions—particularly between the US and China—deepen. As a result, air cargo markets continue to contract. Nobody wins a trade war. Borders that are open to trade spread sustained prosperity. That’s what our political leaders must focus on,” said Alexandre de Juniac, IATA’s Director General and CEO. |

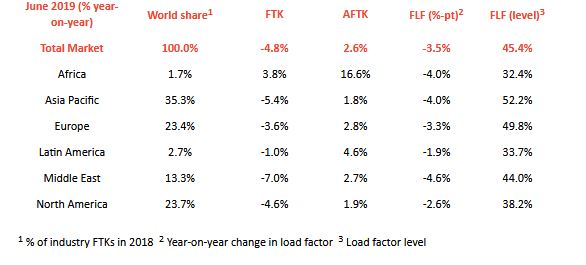

| Regional Performance Airlines in Asia-Pacific and the Middle East once again suffered the sharpest declines in year-on-year growth in total air freight volumes in June 2019. Africa was the only region to show any growth. Asia-Pacific airlines saw demand for air freight contract by 5.4% in June 2019, compared to the same period in 2018. Although an important factor, the US-China trade war is not solely responsible for the fall. FTKs for the within-Asia market have decreased more than 10% over the past year. Air freight capacity increased by 1.8% over the same period. North American airlines’ freight demand decreased by 4.6% in June 2019, compared to the same period a year earlier. Capacity increased by 1.9% over the past year. US-China trade tensions are weighing on the performance, with FTKs to Asia down 5%. FTKs on routes to/from Europe, South America and Middle East were also lower. European airlines posted a 3.6% decrease in freight demand in June 2019 compared to the same period a year earlier. Comparatively strong cargo volumes within Europe are helping to minimize the impact of weaker German exports. Capacity increased by 2.8% year-on-year. Middle Eastern airlines’ freight volumes decreased 7.0% in June 2019 compared to the year-ago period. Capacity increased by 2.7%. Seasonally-adjusted demand has been falling since late 2018, and the latest data show volumes to Europe (-7.2%) and Asia-Pacific (-6.5%) were particularly weak. Latin American airlines experienced a decrease in freight demand in June 2019 of 1.0% compared to the same period last year and capacity increased by 4.6%. Much of the decline in traffic can be attributed to weakness in the within-South America market (especially Brazil and Argentina) where FTKs fell 6.5%. African carriers were the only ones to report growth in June 2019, with an increase in demand of 3.8% compared to the same period a year earlier. This makes Africa the strongest performer for the fourth consecutive month. Capacity grew 16.6%. Route analysis shows that the Africa-Asia performance is strong—up 12% year-on-year. |

| IATA (International Air Transport Association) represents some 290 airlines comprising 82% of global air traffic. You can follow us at twitter.com/iata for announcements, policy positions, and other useful industry information. Explanation of measurement terms: FTK: freight tonne kilometers measures actual freight traffic AFTK: available freight tonne kilometers measures available total freight capacity FLF: freight load factor is % of AFTKs used IATA statistics cover international and domestic scheduled air freight for IATA member and non-member airlines. Total freight traffic market shares by region of carriers in terms of FTK are: Asia-Pacific 35.3%, Europe 23.4%, North America 23.7%, Middle East 13.3%, Latin America 2.7%, and Africa 1.7%. Source IATA |

Air Freight in Decline

Be the first to comment on "Air Freight in Decline"