·In 3Q19, Embraer delivered 17 commercial and 27 executive (15 light and 12 large) jets, compared to 15 commercial jets and 24 executive (17 light and 7 large) jets in 3Q18;

·The Company’s firm order backlog at the end of 3Q19 was US$ 16.2 billion;

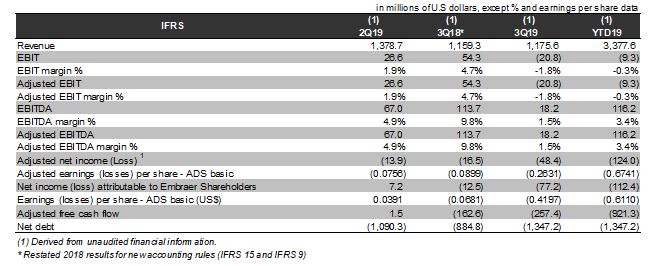

·EBIT and EBITDA in 3Q19 were US$ (20.8) million and US$ 18.2 million, respectively, yielding EBIT margin of -1.8% and EBITDA margin of 1.5%. The quarterly results were impacted by separation costs of US$ 34.8 million related to the carve out of Embraer’s Commercial Aviation business. In the first nine months of 2019 the Company’s EBIT was US$ (9.3) million (EBIT margin of -0.3%) and EBITDA was US$ 116.2 million (EBITDA margin of 3.4%). In the same period separation costs represented US$ 66.6 million;

·3Q19 Net loss attributable to Embraer shareholders and Loss per ADS were US$ (77.2) million and US$ (0.42), respectively. Adjusted net loss (excluding deferred income tax and social contribution) for 3Q19 was US$ (48.4) million, with Adjusted loss per ADS of US$ (0.26). Embraer reported adjusted net loss in 3Q18 of US$ (16.5) million, for an adjusted loss per ADS of US$ (0.09) in the quarter;

·Embraer reported 3Q19 Free cash flow of US$ (257.4) million, versus free cash flow of US$ (162.6) million reported in 3Q18;

·Embraer updates its 2019 and 2020 guidance. For 2019, Embraer reaffirms deliveries of 85 – 95 commercial jets, 90 – 110 executive jets, two KC-390 aircraft, and now expects five Super Tucano deliveries. The Company reaffirms guidance for 2019 revenues of US$ 5.3 – 5.7 billion and breakeven EBIT margin, while removing the estimates related to the consummation of the strategic partnership with Boeing by the end of the year. Embraer also introduces 2019 Free Cash Flow guidance for a use of US$ (300) – US$ (100) million for the year;

·For 2020, Embraer reaffirms revenues of US$ 2.5 – US$ 2.8 billion, EBIT margin of 2 – 5%, and breakeven Free Cash Flow, and now expects a special dividend of between US$ 1.3 billion and US$ 1.6 billion to be paid in 2020. Please see more on page 2 of this press release.

MAIN FINANCIAL INDICATORS

[1] Adjusted Net Income (loss) is a non-GAAP measure, calculated by adding Net Income attributable to Embraer Shareholders plus Deferred income tax and social contribution for the period, in addition to adjusting for non-recurring items. Under IFRS for Embraer’s Income Tax benefits (expenses) the Company is required to record taxes resulting from unrealized gains or losses due to the impact of changes in the Real to US Dollar exchange rate over non-monetary assets (primarily Inventory, Intangibles, and PP&E). The taxes resulting from gains or losses over non-monetary assets are considered deferred taxes and are presented in the consolidated Cash Flow statement, under Deferred income tax and social contribution, which was US$ (4.0) million in 3Q18, US$ 28.8 million in 3Q19 and US$ (21.1) million in 2Q19. There were no special items recognized in 3Q18, 3Q19, or 2Q19. For a reconciliation of Adjusted Net Income (loss) please see page 12 of this release.

ABOUT EMBRAER

A global aerospace company headquartered in Brazil, Embraer celebrates its 50th anniversary with businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customer after-sales.

Since it was founded in 1969, Embraer has delivered more than 8,000 aircraft. On average, about every 10 seconds an aircraft manufactured by Embraer takes off somewhere in the world, transporting over 145 million passengers a year.

Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe.

For more information, please visit embraer.com

Be the first to comment on "Embraer Results 3Q19"